To listen to the full episode check it out here: The Daily Dose Podcast

Cannabis Taxes And Black Market Disruptions Explained

1. Introduction

In recent years, the legalization of cannabis for both medicinal and recreational use has been a rapidly evolving topic across the United States. One city at the forefront of this movement is San Francisco, where the cannabis industry has seen tremendous growth. However, along with its legalization, concerns about the thriving black market for cannabis have emerged.

To combat this issue, the city decided to take an unprecedented step by suspending cannabis taxation, aiming to reshape the landscape of the cannabis industry and curb illegal sales. In this article, we will explore the motivations behind this decision and the implications it has on the city’s cannabis market.

2. The Rise of Legal Cannabis

The legalization of cannabis has gained momentum in the United States over the past few decades. As of our last knowledge update in January 2022, 17 states had fully legalized recreational cannabis, while 37 had legalized it for medical use. San Francisco, known for its progressive stance on social and political issues, embraced this movement by allowing both medical and recreational cannabis sales.

With legalization came a regulated market where consumers could purchase cannabis products from licensed dispensaries, ensuring quality and safety. This marked a significant shift from the days of prohibition when the cannabis market was primarily controlled by illegal operators.

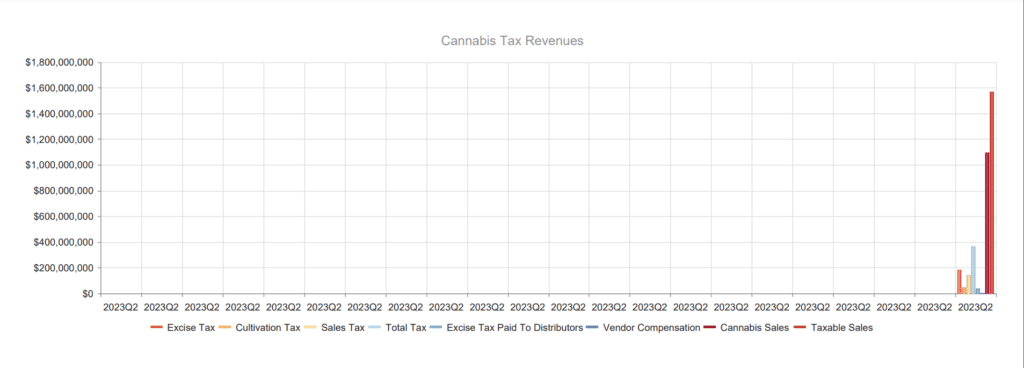

3. San Francisco’s Cannabis Taxation

To capitalize on the growing cannabis industry, San Francisco, like many other municipalities, introduced taxation on cannabis products. These taxes, including excise, sales, and local taxes, served as a crucial revenue source for the city. Cannabis businesses were required to pay these taxes, and the costs were often passed on to the consumers, making legal cannabis more expensive than its black market counterpart.

While taxation allowed the city to fund various programs and initiatives, it inadvertently fueled the growth of the illicit cannabis market, as consumers sought more affordable alternatives. The question then arose: how could San Francisco address the proliferation of illegal cannabis sales while sustaining the revenue generated from the legal industry?

4. The Black Market Dilemma

The thriving black market for cannabis posed several challenges. Firstly, illegal operators did not adhere to the same stringent regulations and quality control standards that legal businesses were required to follow. This lack of oversight meant that consumers had less assurance about the safety and quality of the products they were purchasing.

Furthermore, the black market posed a threat to the legal cannabis industry by undercutting prices and diverting potential customers. Legal businesses struggled to compete with the lower prices offered by illicit sellers, hindering their growth and success.

5. The Decision to Suspend Cannabis Taxes

In response to the escalating black market dilemma, San Francisco made a bold and unprecedented move by suspending cannabis taxation. The decision was grounded in a comprehensive analysis of the cannabis market dynamics, and it aimed to address several pressing issues.

This suspension, introduced through city legislation, effectively removed the burden of marijuana taxes from legal businesses. The decision was met with both anticipation and skepticism, as it had the potential to reshape the cannabis landscape in the city.

6. Impact on Legal Cannabis Businesses

With the suspension of cannabis taxation, legal cannabis businesses in San Francisco found themselves in a unique position. No longer burdened with high tax rates, they could lower their prices and become more competitive with the black market. This move was seen as a positive development for the legal industry, potentially attracting more customers and driving growth.

Lower prices could also encourage consumers who were previously purchasing from the illegal market to switch to legal options. The hope was that this shift in consumer behavior would lead to a reduction in illegal sales and contribute to the overall success of the legal cannabis market.

7. A Closer Look at the Black Market

While the suspension of marijuana taxes had the potential to disrupt the black market, it was essential to understand the root causes of its persistence. The black market thrived due to various factors, including price differentials, convenience, and lingering stigmas associated with legal cannabis. To address these issues, the city needed to take a multifaceted approach.

One of the key reasons the black market continued to flourish was the price difference between legal and illegal cannabis. Tax-free cannabis products became more affordable for consumers, providing a compelling incentive to opt for legal purchases. However, this was not the sole driver of illegal sales.

8. Possible Solutions

To tackle the black market problem comprehensively, San Francisco needed to go beyond the suspension of marijuana taxes. The city began exploring several solutions to create a more balanced and fair cannabis landscape.

a. Price Regulation: Regulating the pricing of legal cannabis products to ensure they remain competitive with the black market, even after taxes are reintroduced.

b. Consumer Education: Educating the public about the risks associated with black market purchases, such as product quality, safety, and the legal consequences.

c. Enforcement: Strengthening law enforcement efforts to combat illegal cannabis operations and disrupt supply chains.

d. Equity Programs: Implementing equity programs to support individuals from communities disproportionately affected by the war on drugs to enter the legal cannabis industry.

9. Community and Stakeholder Perspectives

The suspension of marijuana taxes in San Francisco sparked extensive debates and discussions among various stakeholders, including cannabis businesses, community leaders, and public health advocates.

Some cannabis businesses were cautiously optimistic about the tax suspension, as it provided a unique opportunity to thrive in a competitive environment. Others remained concerned about the potential long-term impact on the city’s revenue and the possibility of taxes being reintroduced at higher rates in the future.

Community leaders weighed the potential benefits of the move, including job creation and revenue generation, against the risks, such as increased accessibility to cannabis, especially among vulnerable populations.

Public health advocates raised concerns about the potential increase in cannabis consumption, particularly among youth, and the need for strong regulations to safeguard public health.

10. Conclusion: Shaping a Sustainable Cannabis Future

In conclusion, San Francisco’s suspension of cannabis taxes represents a bold step towards addressing the persistent black market issue. While it offers potential benefits to legal cannabis businesses and consumers, it also poses challenges and uncertainties. To create a sustainable cannabis future, it is essential to strike a balance between supporting the legal industry and implementing effective measures to curtail illegal sales.

The decision to suspend taxes is just one piece of the puzzle in the ongoing evolution of the cannabis industry in San Francisco. It will be crucial to monitor its effects, engage with stakeholders, and adapt strategies as needed to ensure a thriving legal cannabis market while curbing the black market.

In this dynamic landscape, San Francisco is setting a precedent for how municipalities can adapt to the challenges posed by the black market while supporting a legal cannabis industry that contributes to local revenue and economic growth. The coming years will reveal the true impact of this decision and shape the future of cannabis in the city.

FAQs

What motivated San Francisco to suspend taxes?

How will the suspension of taxes affect legal cannabis businesses?

Will taxes be reintroduced in the future?

What measures are being taken to combat the black market?

Related Articles:

- Cannabis News Today THC Carts On The Rise

- Cannabis Tax Revenue Explodes What Now

- Cannabis Seizures And Black Market Weed

- Pot Politics The State Of Cannabis

- Cannabis Tax Continues To Grow News Now

Meet The Author